Are payday loans with no credit check safe? This is a question that many people ask when they are considering taking out a payday loan.

The truth is that there is no easy answer to this question. Payday loans can be safe if you use them responsibly and only borrow what you can afford to repay. However, they can also be very risky if you don’t manage them correctly.

If you’re thinking about taking out a payday loan, it’s important that you do your research and understand the risks involved. Only borrow money that you can afford to repay, and make sure you have a plan in place to repay the loan as soon as possible.

Do you have any experience with payday loans? Share your story in the comments below.

What Are Payday Loans

A payday loan is a type of loan where you borrow a small amount of money – usually between $100 and $500 – and repay it on your next payday. These loans are also known as cash advance loans or check advance loans.

If you’re in need of some quick cash and you don’t have time to wait for a traditional loan to be approved, a payday loan from HonestLoans could be a good option for you. These loans are designed to be quick and easy to get, so you can get the cash you need as soon as possible.

However, payday loans come with a number of risks. Firstly, because these loans are so easy to get, you may be tempted to borrow more than you need. This can lead to you getting into financial trouble if you’re unable to repay the loan.

Secondly, the fees and interest rates on payday loans are usually much higher than traditional loans. This means that you could end up paying back quite a bit more than you borrowed.

Finally, if you don’t repay a payday loan, it could negatively impact your credit score. This could make it more difficult for you to get approved for loans in the future.

If you’re considering taking out a payday loan, it’s important to understand the risks involved. However, if you’re in a financial bind and you need cash fast, a payday loan could be a good option for you.

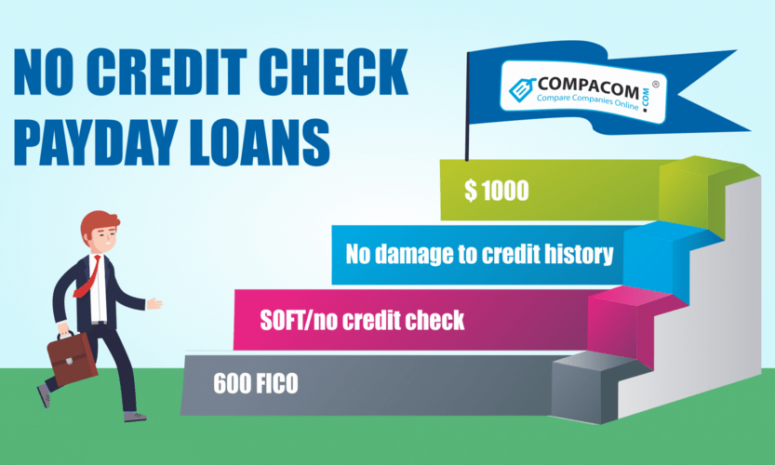

Benefits of Payday Loans with No Credit Check

Have you ever found yourself in a situation where you need cash urgently, but your credit score is holding you back from getting a loan? Payday loans with no credit check can be the perfect solution for you.

There are many benefits of taking out a payday loan with no credit check, and these include:

- Fast and easy approval: Payday loans with no credit check are usually much easier to get approved for than traditional loans. This is because there is no credit check involved, so your credit score is not a factor.

- Get the cash you need when you need it: With a payday loan with no credit check, you can get the cash you need when you need it. This is perfect for those unexpected expenses that come up, such as car repairs or medical bills.

- No impact on your credit score: Because there is no credit check involved, taking out a payday loan with no credit check will not impact your credit score. This is a great option for those who are trying to rebuild their credit.

- Flexible repayment options: Most payday loans with no credit check offer flexible repayment options, so you can choose a schedule that suits your needs.

- Lower interest rates: Payday loans with no credit check often have lower interest rates than traditional loans, so you can save money in the long run.

If you are in need of cash and have bad credit, a payday loan with no credit check could be the perfect solution for you. With fast and easy approval, flexible repayment options, and lower interest rates, there are many benefits to taking out a payday loan with no credit check.

How Can I Get Payday Loans with No Credit Check

If you’re in need of some extra cash and you don’t have good credit, you may be wondering how you can get a payday loan with no credit check. There are actually quite a few options available to you.

First, you can try to find a lender who doesn’t require a credit check. This may be difficult, as most lenders will at least pull a basic report. However, there are some lenders out there who are willing to work with people with bad credit.

Another option is to get a payday loan from a friend or family member. If you have someone who is willing to lend you the money, this can be a great option. Just be sure to repay the loan on time to avoid any problems.

Lastly, you can also use a payday loan alternative, such as a payday loan from a credit union. These loans can be a great option as they often have lower interest rates and fees.

If you need a payday loan but don’t have good credit, there are still several options available to you. Speak with a lender, look into payday loan alternatives, or borrow from a friend or family member to get the cash you need.

What Are Other No Credit Check Loans

If you’re like most people, you probably think of loans as being either good or bad. But there’s another type of loan that’s often overlooked: the no credit check loan.

No credit check loans are exactly what they sound like: loans that don’t require a credit check. This can be a good option for people with bad credit or no credit, as it allows them to access the money they need without having to go through a credit check.

There are a few things to keep in mind with no credit check loans, however. First, they will likely have a higher interest rate than traditional loans. Second, they may have a shorter repayment period, meaning you’ll need to pay back the loan more quickly.

If you’re considering a no credit check loan, be sure to do your research and compare rates from different lenders. And remember, as with any loan, be sure to read the terms and conditions carefully before you sign anything.